Why You Should Consider Investing in an Umbrella Insurance Policy

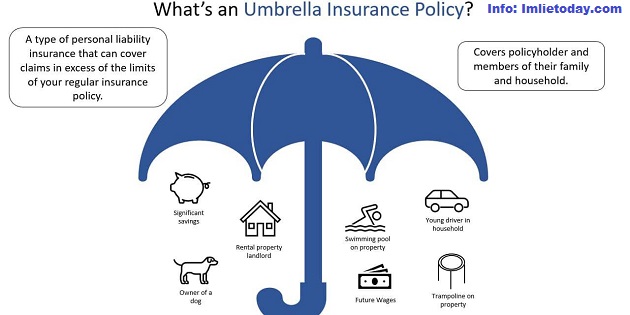

When it comes to protecting your financial assets, having the right insurance policies in place is essential. While most people understand the need for auto, home, and health insurance, there is one policy that often gets overlooked – umbrella insurance. An umbrella insurance policy provides an extra layer of liability coverage that can safeguard your financial future. In this article, we will explore the top reasons why you should consider investing in an umbrella insurance policy.

1. Enhanced Liability Protection

One of the primary reasons to invest in an umbrella insurance policy is to enhance your liability protection. While your existing insurance policies may provide a certain level of liability coverage, they often have limits. In the event of a major accident or lawsuit, the damages awarded could exceed the limits of your primary policies. An umbrella policy kicks in when your other insurance coverage is exhausted, providing you with additional protection against claims and lawsuits.

2. Coverage for a Wide Range of Situations

Another advantage of umbrella insurance is that it provides coverage for a wide range of situations. Whether you are involved in a car accident, someone gets injured at your home, or you face a lawsuit due to a social media post, an umbrella policy can help cover the costs associated with these incidents. It acts as an extra safety net that extends your liability coverage across different aspects of your life, giving you peace of mind.

3. Protection Against High-Cost Lawsuits

In today’s litigious society, lawsuits can result in substantial financial damages. If you are sued and found liable for someone else’s injury or property damage, you could be faced with a significant financial burden. An umbrella insurance policy can provide the necessary funds to cover legal fees, settlements, and judgments, protecting your savings, investments, and other valuable assets.

4. Safeguarding Your Future Income

Investing in an umbrella insurance policy is not only a way to protect your current assets but also to safeguard your future income. If you are found responsible for a substantial financial loss, a creditor could potentially go after your wages, savings, or other sources of income. By having an umbrella policy, you can help shield your future earnings from being seized in the event of a lawsuit.

5. Affordable Coverage

Contrary to popular belief, umbrella insurance is surprisingly affordable. Considering the extensive financial protection it offers, the premiums for umbrella policies are relatively low. The cost varies depending on factors such as your assets, liability limits, and the insurance company you choose. In most cases, the peace of mind and added security of umbrella insurance far outweigh the cost of the premiums.

6. Worldwide Coverage

An umbrella insurance policy typically provides coverage worldwide. Whether you are traveling domestically or internationally, your policy’s liability protection follows you wherever you go. This is particularly beneficial if you frequently travel for business or leisure, as it ensures that you are covered in various situations and locations.

7. Fill Coverage Gaps

It’s important to note that an umbrella insurance policy does not just provide additional liability coverage but also helps fill coverage gaps in your existing policies. For example, some primary insurance policies may exclude certain types of claims or have specific limitations. An umbrella policy can bridge those gaps, ensuring that you have comprehensive coverage across all aspects of your life.

8. Peace of Mind

Perhaps one of the most significant reasons to invest in an umbrella insurance policy is the peace of mind it brings. Life is unpredictable, and accidents or lawsuits can happen to anyone. By having umbrella coverage, you can rest easy knowing that you have an added layer of protection to shield your financial well-being in the face of unexpected events.

As you can see, investing in an umbrella insurance policy offers numerous benefits, including enhanced liability protection, coverage for a wide range of situations, protection against high-cost lawsuits, safeguarding your future income, and affordable coverage. Additionally, an umbrella policy provides worldwide coverage and fills coverage gaps in your existing policies. Ultimately, having umbrella insurance grants you the peace of mind you deserve, knowing that your financial assets are secure. Don’t underestimate the importance of this often overlooked policy, and be sure to consult with an insurance professional to explore your options and determine the coverage that best suits your needs.

How an Umbrella Insurance Policy Works

Understanding how an umbrella insurance policy works is crucial in making an informed decision. Umbrella insurance is designed to provide excess liability coverage beyond what your primary insurance policies offer. Here’s a breakdown of how it works:

1. Coverage Limits: Umbrella insurance policies typically provide coverage limits ranging from $1 million to $10 million or more. These limits are above and beyond the liability limits of your underlying policies.

2. Primary Insurance Requirement: To be eligible for an umbrella policy, you usually need to have certain minimum liability coverage on your primary insurance policies, such as auto and homeowners insurance. The exact requirements may vary depending on the insurance company.

3. Coverage Trigger: Umbrella insurance kicks in once the liability limits of your primary policies are exhausted. If a claim exceeds the limits of your auto or homeowners insurance, the umbrella policy will cover the remaining costs up to its coverage limit.

4. Wide Range of Coverage: Umbrella insurance provides liability coverage for a broad spectrum of incidents, including but not limited to personal injury, property damage, landlord liability, false arrest, libel, slander, and certain lawsuits. It essentially acts as an extra layer of protection across multiple areas of your life.

5. Legal Defense Costs: In addition to covering the costs of settlements or judgments, an umbrella policy also helps pay for legal defense fees. This includes attorney fees, court costs, and other expenses associated with defending yourself in a lawsuit.

6. Exclusions: Like any insurance policy, umbrella insurance also has exclusions. It’s essential to review the terms and conditions of the policy to understand what is not covered. Common exclusions may include intentional acts, criminal activities, professional liabilities, and certain types of business activities.

7. Deductible Requirements: Umbrella insurance policies typically have a deductible that needs to be met before the coverage is triggered. The deductible is the amount you are responsible for paying out of pocket before the policy starts paying for covered claims.

8. Consult an Insurance Professional: Given the complexities involved in selecting and understanding the terms of an umbrella insurance policy, it’s advisable to consult with an experienced insurance professional. They can assess your specific needs, explain the policy details, and help you determine the appropriate coverage limits for your situation.

Imlie Today

Imlie Today