Welcome to our comprehensive guide on how to get insurance in the United States! Insurance is an essential part of protecting yourself, your loved ones, and your belongings from unexpected events. In this article, we will explore the different types of insurance available in the USA and provide you with valuable insights on how to navigate the insurance landscape.

The Importance of Insurance

Insurance plays a vital role in safeguarding individuals, families, businesses, and properties from financial risks. It provides a safety net and peace of mind by covering various unforeseen events such as accidents, natural disasters, medical emergencies, and much more. With the right insurance coverage, you can mitigate potential losses and ensure a secure future.

History

The principal insurance agency in the US guaranteed fire protection and was shaped in Charleston, South Carolina, in 1735. In 1752, Benjamin Franklin assisted structure a shared protection with companying called the Philadelphia Contributionship, which is the country’s most established protection transporter still in operation. Franklin’s organization was quick to make commitments toward fire counteraction. Besides the fact that his organization cautioned against specific fire dangers, it would not protect specific structures where the gamble of fire was excessively perfect, for example, all wooden houses.

The principal stock insurance agency framed in the US was the Insurance Agency of North America in 1792. Massachusetts sanctioned the primary state regulation requiring insurance agency to keep up with satisfactory stores in 1837. Formal guideline of the protection business started vigorously when the principal state magistrate of protection was selected in New Hampshire in 1851. In 1859, the Province of New York named its own chief of protection and made a state protection division to move towards more far reaching guideline of protection at the state level.

Protection and the protection business has developed, expanded and grew altogether from that point forward. Insurance agency were, to a great extent, restricted from composing more than one line of protection until regulations started to allow multi-line contracts during the 1950s. From an industry overwhelmed by little, nearby, single-line common organizations and part social orders, the matter of protection has developed progressively towards multi-line, multi-state and even worldwide protection combinations and holding organizations

Government Guideline of Protection

By and by, government guideline has kept on infringing upon the state administrative system. The possibility of a discretionary bureaucratic sanction was first raised after a spate of dissolvability and limit issues tormented property and loss guarantors during the 1970s. This OFC idea was to lay out an elective government administrative plan that guarantors could pick into from the customary state framework, to some degree similar to the double sanction guideline of banks. Albeit the discretionary government contracting proposition was crushed during the 1970s, it turned into the antecedent for a cutting edge banter over discretionary bureaucratic sanctioning in the last decade.

President Obama marking Dodd-Blunt Change Act into regulation

In 1979 and the mid 1980s the Government Exchange Commission endeavored to control the protection business, yet the Senate Trade Board of trustees casted a ballot collectively to restrict the FTC’s endeavors. President Jimmy Carter endeavored to make an “Office of Protection Examination” in the Depository Division, however the thought was deserted under industry pressure.

Throughout the course of recent many years, restored calls for discretionary government guideline of insurance agency have sounded, including the Gramm-Filter Bliley Act in 1999, the proposed Public Protection Act in 2006 and the Patient Security and Reasonable Consideration Act (“Obamacare”) in 2010.

In 2010, Congress passed the Dodd-Candid Money Road Change and Buyer Security Act which is promoted by some as the most clearing monetary guideline redesign since the Economic crisis of the early 20s. The Dodd-Plain Demonstration has critical ramifications for the protection business. Altogether, Title V of made the Government Protection Office (FIO) in the Branch of the Depository. The FIO is approved to screen all of the protection business and distinguish any holes in the state-based administrative framework. The Dodd-Straightforward Demonstration additionally lays out the Monetary Security Oversight Gathering (FSOC), which is accused of checking the monetary administrations markets, including the protection business, to recognize expected dangers to the monetary steadiness of the US.

Types of Insurance in the USA

Insurance in the United States encompasses a wide range of categories, each serving a specific purpose. Let’s explore some of the most common types of insurance available:

1. Health Insurance

Health insurance is crucial for every individual and family in the United States. It helps cover medical expenses and provides access to quality healthcare services. Health insurance plans can be obtained through employers or purchased independently from insurance providers. The two main types of health insurance are:

- Private Health Insurance: This type of health insurance is typically obtained through employment or purchased directly from insurance companies. It offers a variety of coverage options, including individual plans, family plans, and group plans.

- Government Health Insurance: The US government provides various health insurance programs such as Medicare for individuals aged 65 and older, Medicaid for low-income individuals and families, and the Children’s Health Insurance Program (CHIP) for children from low-income families.

2. Auto Insurance

Auto insurance is mandatory in most states across the United States. It provides financial protection in case of accidents, theft, or damage to your vehicle. Auto insurance policies typically include liability coverage, collision coverage, and comprehensive coverage. It is essential to compare quotes from different insurance companies to find the best coverage at an affordable price.

3. Homeowners/Renters Insurance

Homeowners insurance is designed to protect your home and its contents from various risks, including fire, theft, vandalism, and natural disasters. Renters insurance, on the other hand, provides coverage for belongings and liability for individuals renting a property. Both homeowners and renters insurance offer peace of mind and financial security in case of unexpected incidents.

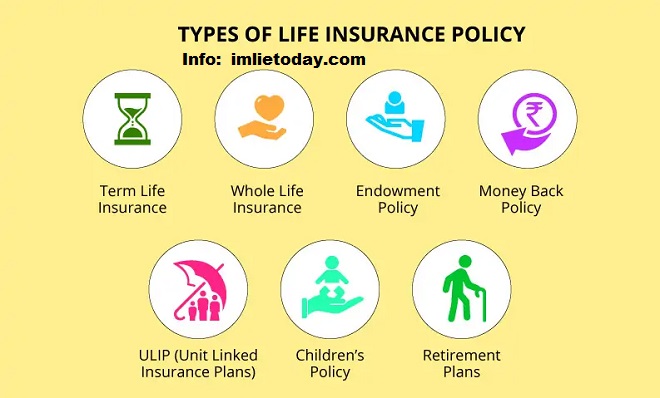

4. Life Insurance

Life insurance provides financial protection for your loved ones in the event of your passing. It pays out a lump sum to beneficiaries, helping them cover expenses such as funeral costs, mortgage payments, and everyday living expenses. There are different types of life insurance policies, including term life insurance, whole life insurance, and universal life insurance. It’s important to assess your needs and understand the various options available before choosing a policy.

5. Disability Insurance

Disability insurance provides income replacement in the event you become disabled and are unable to work. It ensures financial stability and helps cover living expenses during the period of disability. Disability insurance policies vary in terms of coverage and waiting periods, so it’s crucial to carefully review the terms and conditions before making a decision.

6. Business Insurance

Business insurance protects companies from various risks and liabilities associated with their operations. It includes coverage for property damage, liability claims, business interruption, professional liability, and more. Business owners should assess their specific needs and consult with insurance professionals to determine the most appropriate coverage for their organization.

7. Umbrella Insurance

Umbrella insurance provides additional liability coverage beyond the limits of your existing insurance policies. It offers protection against lawsuits and claims that may exceed the coverage of your primary insurance policies, such as auto insurance or homeowners insurance. Umbrella insurance is highly recommended for individuals and families with considerable assets.

8. Pet Insurance

Pet insurance helps cover veterinary expenses and medical treatments for your beloved pets. It provides financial assistance in case of accidents, illnesses, or routine check-ups. Pet insurance policies offer different levels of coverage, including accident-only plans, comprehensive plans, and wellness plans.

How to Get Insurance in the United States

Getting insurance in the United States involves a few important steps. Here’s a simplified guide to help you through the process:

1. Assess Your Insurance Needs

Determine the type of insurance that aligns with your needs. Consider your lifestyle, financial situation, and potential risks. Understanding your requirements will help you choose the most suitable insurance coverage.

2. Research Insurance Providers

Conduct thorough research on insurance companies that offer the type of coverage you require. Look into their reputation, customer reviews, financial stability, and claim settlement history. Shortlist a few reliable insurance providers to compare their offerings.

3. Obtain Quotes

Reach out to the shortlisted insurance providers to request quotes for the desired coverage. Provide accurate information to ensure the quotes are tailored to your circumstances. Compare the coverage, deductibles, premiums, and any additional benefits offered by each provider.

4. Review Policy Terms

Once you’ve chosen an insurance provider, carefully review the terms and conditions of the policy. Pay attention to the coverage details, exclusions, limits, deductibles, and any additional riders or endorsements. Seek clarification from the insurance company or an insurance agent if there are any areas of confusion.

5. Purchase the Insurance Policy

If you are satisfied with the policy terms and coverage, proceed with purchasing the insurance policy. Provide the necessary information, complete the required documentation, and make the initial premium payment. Keep copies of all documents and receipts for future reference.

6. Maintain Regular Payment and Review Coverage

Ensure timely payments of premiums to keep the insurance policy valid. Periodically review your coverage to make sure it still meets your needs. Life events or changes in circumstances may require adjustments to your insurance coverage.

Conclusion

Having the right insurance coverage is essential for protecting yourself, your loved ones, and your assets from unforeseen events. By understanding the various types of insurance available in the United States and following the steps outlined in this guide, you can confidently navigate the insurance landscape and make informed decisions to secure your future. Remember to assess your needs, research insurance providers, obtain quotes, review policy terms, and maintain regular payments. Enjoy the peace of mind that comes with having the appropriate insurance coverage!

Contact Info:

Call us at 1-844-USAGOV1

Imlie Today

Imlie Today